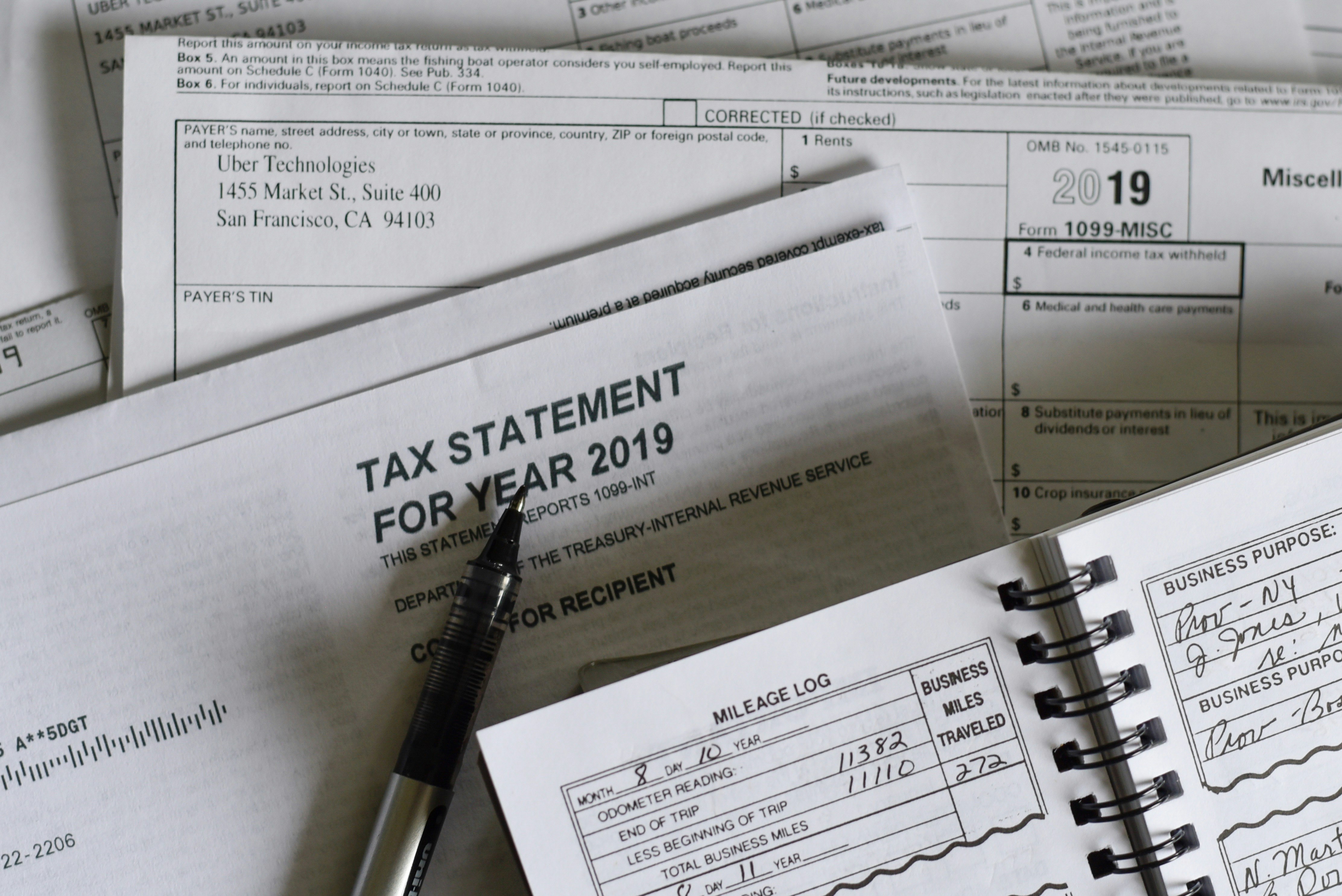

Tax Planning

Proactive Wealth Preservation

Tax codes are complex, but your strategy shouldn't be. We move beyond simple compliance to architect a multi-year tax plan that aligns with your business goals. By analyzing current laws and anticipating future legislation, we position you to keep more of what you earn.

Our Approach

"We do not wait for April 15th. Our team conducts quarterly reviews of your financial picture—investments, business structure, and real estate holdings—to identify opportunities for reduction and deferral before the year closes."

Key Benefits

Our Methodology

A structured approach ensuring accuracy and strategic advantage.

Data Review

We analyze your past returns and current year income projections.

Strategy Design

Identifying tax credits, deductions, and deferral opportunities.

Implementation

Executing entity adjustments and tax-advantaged contributions.

Monitoring

Quarterly reviews to adjust for new laws or financial changes.

Ready to optimize your financial strategy?

Schedule a discovery call with our senior partners today.